Energy-efficient windows and doors are essential for saving energy, reducing bills, and ensuring a comfortable living environment. On October 23, 2023, the ENERGY STAR® program introduced new criteria for doors and windows to ensure that they meet stringent energy efficiency standards. In this blog, we’ll break down what you need to know about these requirements and why they matter for your window upgrades.

Understanding Energy Star 7.0 Requirements for Windows and Doors

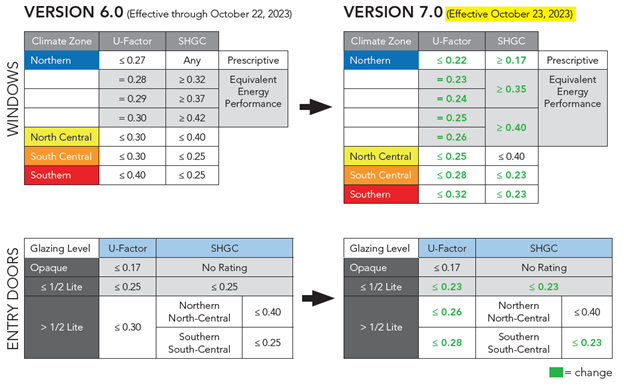

Energy Star 7.0 sets new standards for energy-efficient windows and doors based on different climate zones. Here’s a breakdown of the new requirements for each zone:

For context, U-Factor measures the rate of heat transfer through a window. It quantifies how effective a window is at insulating and preventing heat from escaping a building. The lower the U-Factor, the better a window is at insulating. SHGC (Solar Heat Gain Coefficient) is the measure of the fraction of solar radiation that enters through a window and is released as heat into the building. A high SHGC allows more solar heat energy to pass through the window.

These requirements are tailored to ensure your windows and door perform optimally in your specific climate, offering better insulation and solar heat management.

Why Energy Star 7.0 Matters

Energy-efficient windows and doors are a wise investment for several reasons:

- Lower Energy Bills: They reduce energy consumption, leading to lower utility bills.

- Enhanced Comfort: They provide better insulation and solar heat management, improving home comfort.

- Environmental Benefits: Reduced energy use means a smaller environmental footprint.

- Resale Value: Energy-efficient upgrades can increase your home’s resale value.

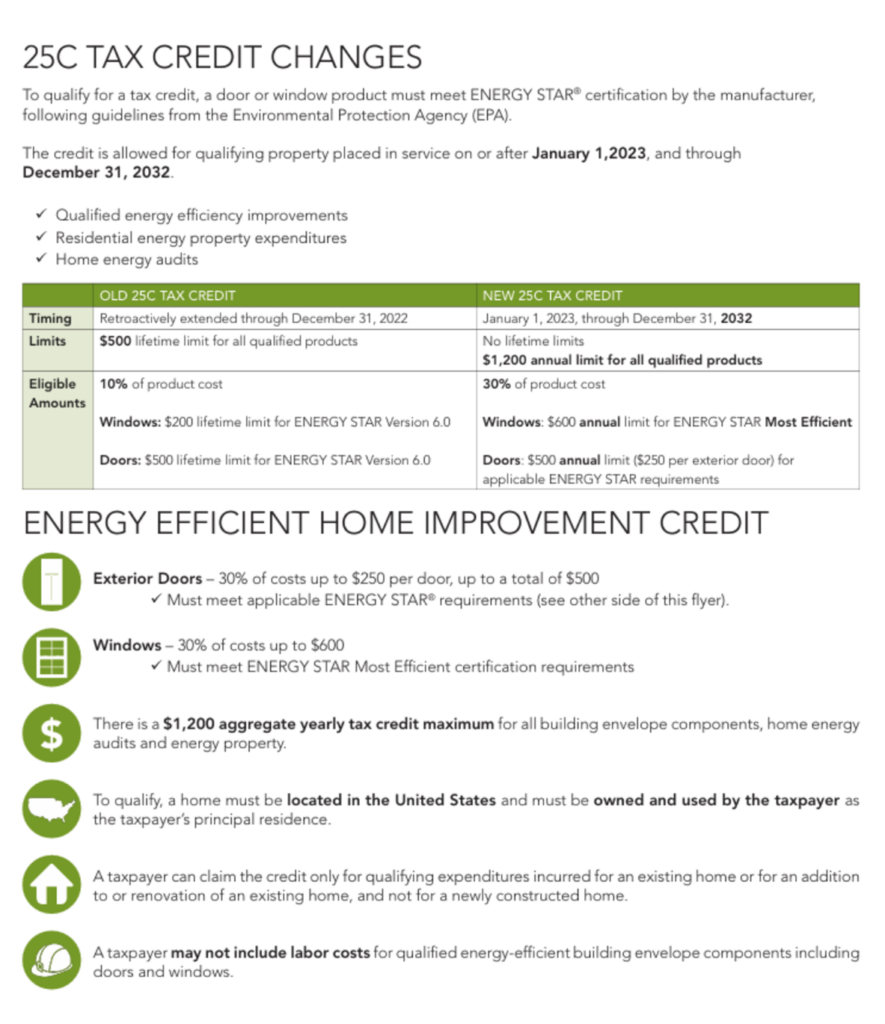

Additionally, the Energy Star program offers tax credits to incentivize these upgrades. The 25C tax credit is now extended through 2032, offering no lifetime limits and a 30% credit on product costs. The Energy-Efficient Home Improvement Credit also provides valuable incentives. Here is a breakdown of both:

(Image: Provia)

If you want to qualify for tax credit for new windows or doors, they must adhere to the new standards set by Energy Star 7.0. For more information regarding tax credit, you can reference the IRS form here.

Where to find tax credit information/links to IRS:

- Residential Clean Energy Credit | Internal Revenue Service

- About Form 5695, Residential Energy Credits | Internal Revenue Service

By choosing windows that meet Energy Star 7.0 requirements, you’re making a positive impact on your finances, your home’s comfort, and the environment.

Energy Star 7.0 requirements empower homeowners to make energy-efficient window choices tailored to their climate zone. By selecting windows that meet these criteria, you’ll enjoy energy savings, a more comfortable home, and a reduced environmental footprint. Plus, with valuable tax credits in place, now is the perfect time to get an estimate and upgrade your windows to enjoy the benefits of a more energy-efficient home.